The Doctor in Your Family

A Week Inside Loop Health's Bet on the Future of Indian Healthcare

Opening Scene

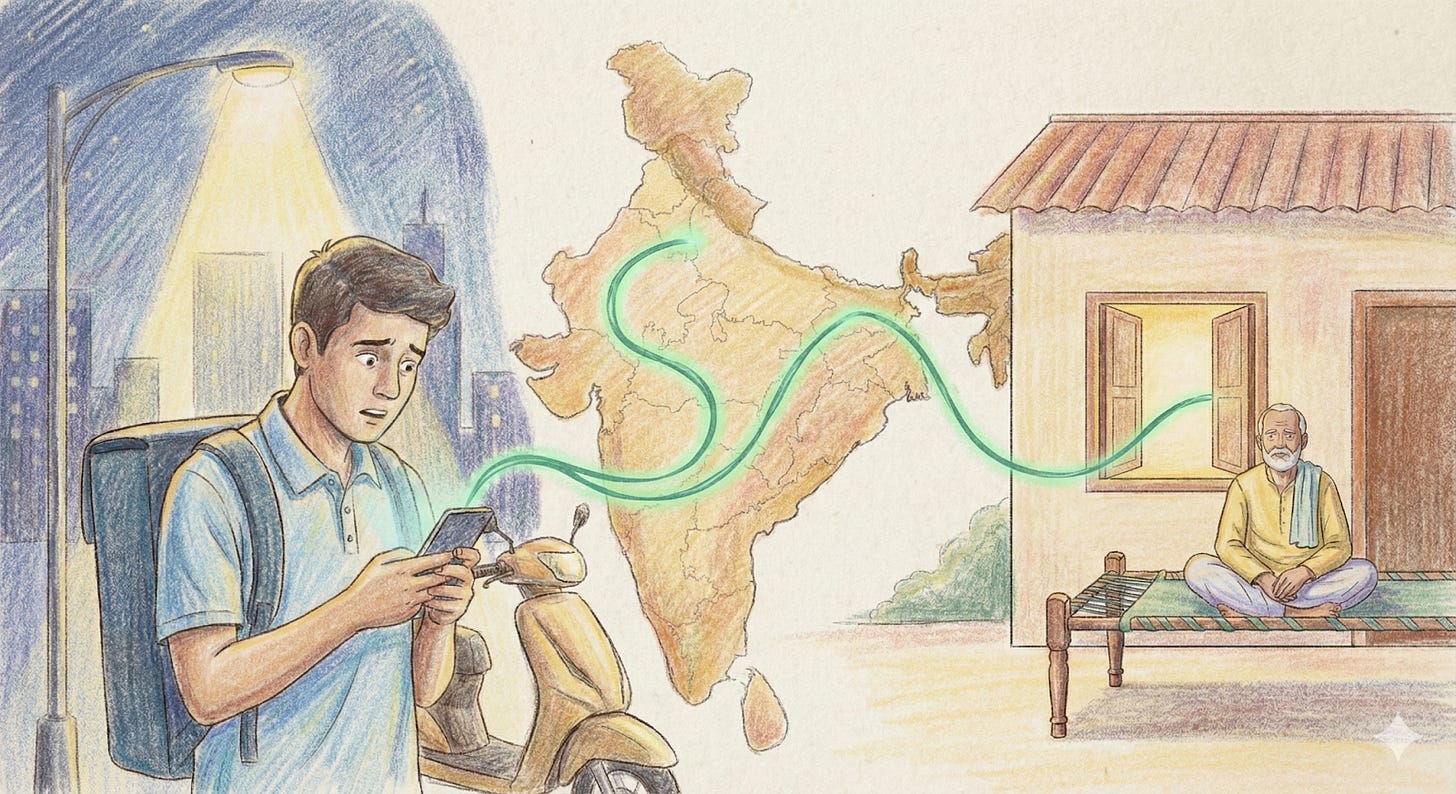

2:17 AM, somewhere in Loop Health’s distributed medical operations. Dr. Priyadarshani’s night shift team is three hours into their watch when the message comes through. A Zepto employee in Gurgaon, awake after his shift, worried about his father’s chest pain. His father is in Patna, 1,100 kilometers away, and doesn’t speak English.

The medical advisor responds in 27 seconds. They can, because they have context: they can see the father’s blood pressure medication from last month’s consultation, the ECG from his company-facilitated health checkup six months ago. They know this family. The MA switches to Hindi, walks through the symptoms. The chest pain started after dinner. Radiating? No. Sharp or dull? Dull. Any sweating? Yes, but it’s humid in Patna.

The doctor, reviewing in real-time, makes the call: likely gastric, but given the sweating and history, safer to check. They coordinate with a hospital in Patna, share the father’s medical history, arrange for an ECG on arrival. The son gets the location, the admission process, what to tell the auto driver. The father goes. It’s gastric. He’s home by 4 AM with antacids and peace of mind.

This interaction, with a parent in hometown, child in metro city, doctor in the cloud, care delivered seamlessly, happens hundreds of times every night through Loop. It’s healthcare that didn’t exist in India five years ago. And it’s the answer to a question most companies don’t even know they’re asking: What if employee benefits actually worked?

Loop Health’s audacious mission reads like something a consultant would dismiss as unrealistic: Add 20 healthy years to India’s workforce. When they announced it, the benefits industry smirked. Insurance is about covering catastrophe, not extending life. But after a week inside Loop Health, watching their infrastructure hum at 2 AM, reading their data on India’s hidden health crisis, understanding what they’ve built over eight years, that mission starts looking less like aspiration and more like inevitability.

Part 1: The Great Budget Leak

“When we started, we thought we were fixing insurance,” Ryan Singh, co-founder and COO at Loop Health, tells me. “Eight years later, we realized we were fixing something much deeper, the fundamental mismatch between what companies spend on health and what employees actually receive.”

To understand Loop’s bet on the future, you need to understand how Indian employee benefits became a ₹30,000-per-head exercise in wishful thinking. Ryan maps it across four generations, each solving yesterday’s problem while creating tomorrow’s crisis.

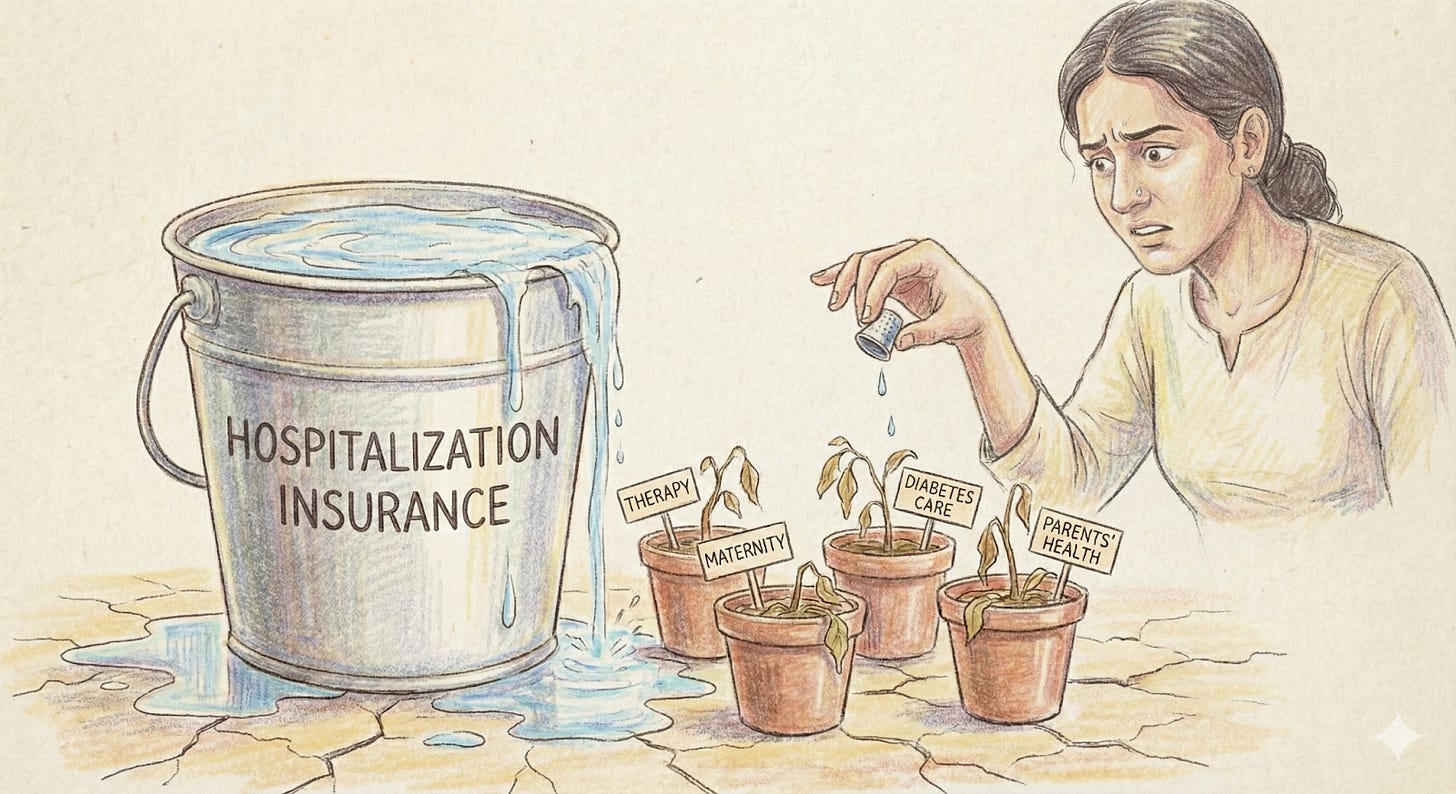

Generation 1 (1990s-2000s) was never about health at all. It was tax optimization through a ‘benefits program.’ HRA, LTA, and conveyance allowances had one goal: minimizing tax burden, not keeping people healthy. Healthcare meant basic hospitalization insurance, something you hoped never to touch. Companies structured salaries to save money; employees got coverage they’d only use in a catastrophe.

Generation 2 (2000s-2015) introduced the illusion of choice. TPAs entered, offering flexibility: pick your sum insured, choose co-pay levels, add parents. But flexibility only meant choosing how much hospitalization coverage you wanted, not what care you could access. An employee could select between a ₹3 lakh and ₹5 lakh hospital cover, but their therapy needs, their diabetes medication, their parents’ cataract surgery, all remained out-of-pocket.

Generation 3 (2015-2024) was the digitization wave. Beautiful enrollment portals, instant e-cards, mobile apps that made picking insurance as smooth as ordering food. Companies bolted on wellness vendors ; like Cult.fit memberships, mental health app subscriptions, diagnostic discounts. “By 2020, our clients had an average of six different benefits & wellness vendors,” Ryan recalls. “Employees had six apps, six passwords, six places to remember what they’d signed up for. Utilization sat at 10% because the only time benefits actually worked was if you were hospitalized.”

The numbers tell the story Ryan’s too kind to spell out. This is corporate India’s greatest magic trick. Companies spend ₹20-30K per employee annually on benefits. Only 10% of employees will be hospitalized and get a meaningful benefit, potentially ₹2-5L depending on their sum insured. The other 90% of employees don’t realize any value. They end up spending ₹10-15K out of pocket on the care they actually need: therapy sessions at ₹2,000 each, quit halfway because they can’t afford more; maternity scans and supplements adding up to ₹50K that insurance won’t touch; diabetes monitoring that costs ₹1,000 monthly but isn’t “treatment” enough to claim.

This isn’t a vendor problem or a technology problem. It’s a design problem. The entire system was built for catastrophic coverage, not care.

Loop’s Workforce Health Index, the first report to merge behavioural data with lab test reports across cities, genders, roles and industries, revealed the depth of this crisis. They plan to release this annually, tracking India’s workforce health evolution year by year. The findings were damning: 78.6% of professionals under 30 are Vitamin D deficient, affecting everything from immunity to mental health. 40.6% of women aged 31-40 are clinically anemic during their peak career years. 37.2% show abnormal glucose metabolism. One in five women has PCOS, a condition that affects fertility, metabolism, and mental health, yet most insurance policies don’t acknowledge it exists.

“We kept calling these ‘wellness issues,’” says Ryan. “But that’s like calling a broken leg a ‘mobility challenge.’ These are medical conditions destroying productivity, happiness, and yes, eventually creating the expensive hospitalizations insurance does cover.”

The bitter irony? Companies desperately want healthier employees. CFOs watch insurance premiums rise 20% yearly. CHROs field complaints about benefits nobody uses. But they keep buying the same broken product because the alternative, rebuilding benefits from scratch, seemed impossible.

Until Loop Health spent eight years making it possible.

Part 2: The Infrastructure Years

The revelation came from a simple observation. “Fifty percent of our employees don’t work in the city they grew up in,” Ryan explains. “They have no family doctor. They navigate healthcare through Google, WhatsApp forwards, and whoever their colleague saw last week.”

This was a baseline infrastructure problem. And solving it would take something the Indian benefits industry had never attempted: building actual healthcare delivery, not just paying for it.

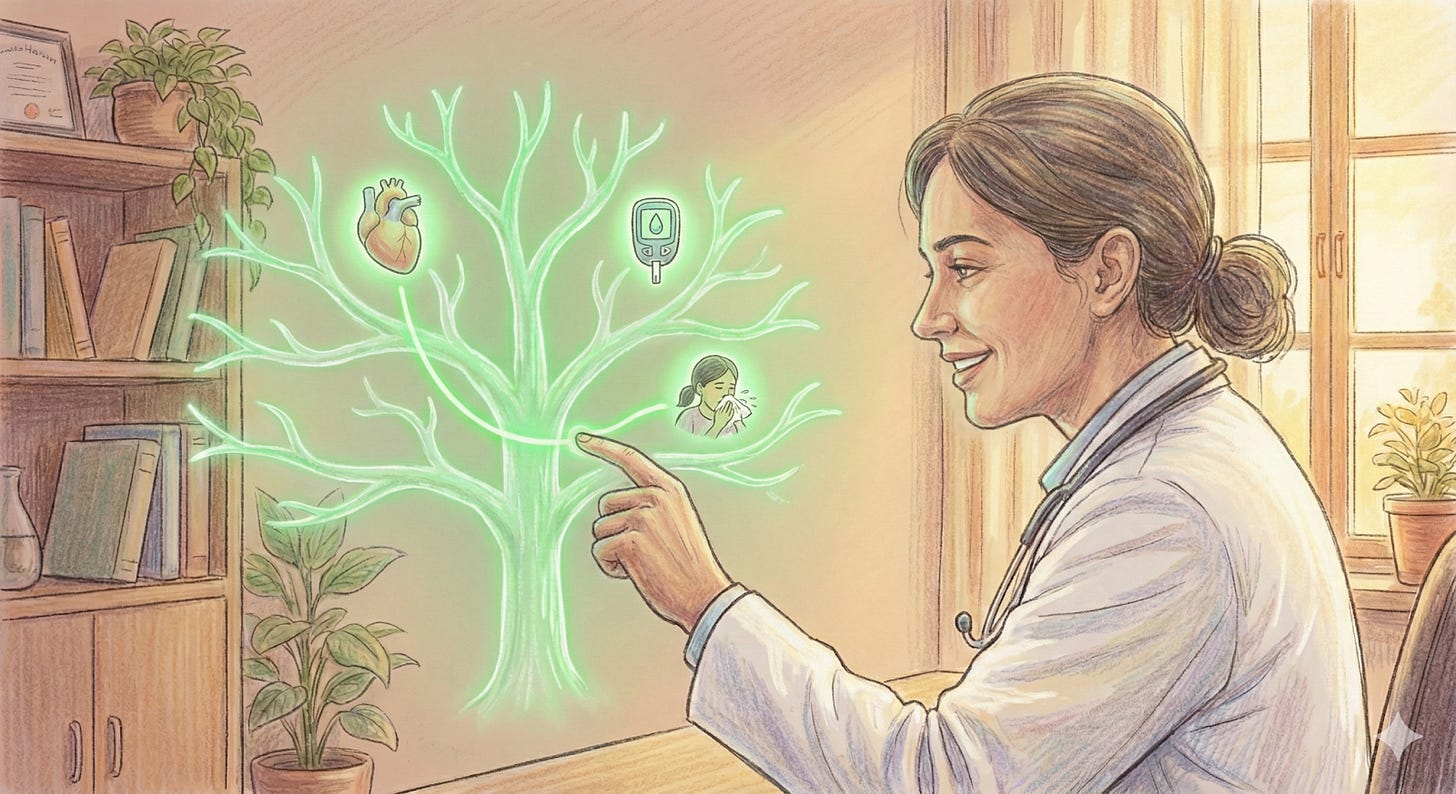

The six-year build started with a controversial decision. While competitors were aggregating wellness vendors and building prettier insurance portals, Loop Health hired doctors. Not to review claims or deny coverage, but to actually treat patients. “We pay our doctors’ salaries and bonuses for keeping our members healthier,” Ryan emphasizes, “Their only job is keeping members healthy. Every hospitalization prevented is a win, not lost revenue. We’re on the side of the patient and payer, not the fee-for-service providers who want to maximize revenue per bed.”

Building their own medical team meant building an entire medical operation. Electronic Medical Records that connected every family member’s health history. Training protocols ensuring consistent care whether the doctor was in Bangalore or Bihar. Clinical workflows that could handle everything from a midnight fever consultation to long-term cancer navigation.

Dr. Mihir Shah, one of Loop’s doctors, explains what this infrastructure enables: “A 64-year-old woman consulted me for worsening diabetes. She’d seen me eight months earlier. In a busy OPD, she’d be a new case. But I could see her EMR instantly and her allergies to certain skincare products stood out. Her palm swelling wasn’t from diabetes; it was an allergic reaction to a new moisturizer. That’s continuity you can’t always get in a hospital.”

The infrastructure means catching strokes at 2 AM. Dr. Mihir recalls a recent night consultation: “The son said his 70-year-old father had a headache. But on video, I saw slurred speech, facial drooping. Those are stroke signs. No medication could help, they needed emergency care immediately. Virtual care has boundaries, and recognizing them saves lives.”

“There was a moment,” Piyush Gupta, Head of Product, recalls, “when a CHRO asked us, ‘Wait, you built an entire EMR system? You trained your own doctors?’” That was when clients started understanding the moat Loop Health had constructed.

The infrastructure includes partnerships that took years to build: diagnostic labs providing instant results and lower waiting periods for Loop members, Tata Memorial Centre partnership for cancer second opinions and navigation, direct deals with mental health providers that lower the ₹3,000-per-session market rate. Each partnership integrated into Loop’s platform, creating what the industry calls “health assurance”, not just covering illness but actively preventing it.

“Our Electronic Medical Records system brings together IPD and OPD claims data, records from chats, consultations, and labs,” Ryan explains. “It creates a complete picture of the member and their family for our clinicians to give personalized care over time. Our doctors not only remember you better, but can help you stay in touch. We’re able to give automated nudges when your prescription runs out or your follow-up consultation is due.”

Consider what this means practically. When an employee messages about their parent’s recurring headaches, the Loop doctor can see the family’s cardiac history, note the father’s hypertension medication, and recognize a pattern that suggests investigation. They order tests through the app, cashless at a partner lab. Results come back showing early markers. The doctor explains them the same day, refers to a neurologist, and follows up weekly. All of this happens before anything becomes an insurance claim.

“We’ve built tools for HR teams to manage everything from enrollment to endorsements,” Piyush explains. “But the real infrastructure is invisible. It’s the clinical protocols ensuring quality, the data systems tracking outcomes, the operational excellence making 24/7 care possible.”

Part 3: The Psychological Unlock

So how do you increase utilization for a product that hasn’t innovated in three generations, that employees dismiss as a “hidden cost” or “kuch toh hai insurance wagerah, pata nahi“?

The breakthrough Loop leaned on was psychological. “Insurance is usually a hidden cost,” Ryan explains. “An employee has no idea how much their employer is spending on their healthcare. The moment you introduce a wallet, that changes.”

The thought process is simple: take the company’s existing ₹30K benefits budget and split it. ₹20K goes toward smarter insurance design. The remaining ₹10K becomes a visible healthcare wallet that employees control. Same budget. Smarter allocation.

This core innovation is what they call HealthFlex.

“When employees see that wallet, they realize their company is contributing for their family every year, and can now spend it on things their family can really benefit from,” Ryan says. “Psychology-wise, that feels very different. In feedback, employees tell us things that basically mean: you’re more transparent, I can see the value, I can literally put a number to an emotion of ‘my company cares about me.’”

“We didn’t get that on day one,” Ryan admits. “We came to that consensus after a few iterations and a lot of research.”

The wallet revealed unexpected behavioral patterns that took time to understand. “On the bundles and utilization side, we learnt a bunch of things the hard way,” Ryan explains. “One big insight: in corporate insurance, caring about your parents is a primary driver. I might not need insurance today, but my parents definitely need it. Same with very clear life events. My parents needing proper cover, my fiancée going in for delivery, a planned surgery. These are short, high-stakes events where people want proper help.”

“When we created some of these benefits as purely digital programs, they didn’t pick up. People don’t fully trust only-online programs for critical stuff. They care much more about in-person care in those moments.”

The purchase insights around maternity bundles made that super clear. “Almost all the maternity bundles were being purchased by men, not women,” Ryan discovered. “For male partners, these digital offerings looked high-value. But when a woman sees the same, because it’s very virtual and not very tangible, she might not value it the same way.”

This insight led Loop Health to completely rethink their approach. “We understood that with bundles and cohorts, it’s all about last-mile conversion and real-world value. The next step for us in maternity, for example, is to actually find the right partner and make the benefit more tangible and usable, so utilization goes up.”

The data showed distinct employee cohorts, each with different healthcare needs:

Unmarried professionals under 30 worried about mental health, their parents’ preventive health needs, and fixing the vitamin deficiencies wreaking havoc on their energy. The sandwich generation (35-45, young kids, parents with real disease burden) faced a different crisis entirely. “They’re burned out with dual care responsibilities,” Dr. Priyadarshani observes. “They forget to take care of themselves. Especially women, juggling postpartum recovery, household responsibilities, work pressure, and often friction with extended family about medical decisions.”

“We also saw that only specific cohorts really invest and purchase benefits from the wallet,” Ryan notes. “A large chunk of purchases comes from unmarried males between 25-30 and married folks above 35. Some cohorts hardly purchase anything, for example, women under 25 or under 30. The way we read that is: there just aren’t enough benefits that feel genuinely valuable for those cohorts.”

Dr. Mihir sees how the wallet changes medical conversations: “When patients know they have budget for preventive care, they ask different questions. It’s not ‘Can I afford this test?’ but ‘Should I do this test now?’ That psychological shift from scarcity to choice changes healthcare decisions fundamentally.”

“So behaviorally,” Ryan concludes, “the wallet journey for us now is: make the employer spend visible so it feels like ‘my’ money, structure bundles around real high-stakes use cases, and then go deeper into individual cohorts, understand what they value, and partner accordingly. That’s how we’ve been trying to move the wallet from just a financial construct to something that actually changes utilization and perception.”

Part 4: When Care Gets Real

The stories that matter don’t appear in pitch decks. They surface in Dr. Priyadarshani’s logs, in the medical team’s Slack channels, in the moments when Loop’s infrastructure meets human crisis.

Take Arjun (name changed). Thirty-five, high performer, recently married. Then his performance cratered. Stopped responding to managers, to teammates, to HR. When they finally reached him, someone else was on the phone, informing them Arjun was on a building ledge, planning to jump.

“The HR team called our salesperson, who immediately connected them to our medical team,” Dr. Priyadarshani recounts. “We got a counselor on the phone within minutes. They talked him down, arranged an immediate in-person session in Gurgaon that evening. We saved a life. We even approached and counseled his family.”

But here’s what weighs on Ryan: “Arjun still needs ongoing therapy. Weekly sessions, medication monitoring, regular check-ins. That’s not a one-time intervention. That’s continuous care. This person needs 24x7 care available to him. His company was spending ₹30,000 per employee per year on benefits. We came and helped, but we want to do more. And to do more, we need your help as HR leaders.”

Then there’s the everyday miracle of early detection. Loop’s case study from Druva Software, tells one such story: routine health checkup data flagged concerning markers that led to early cancer detection in an employee who felt fine. The Loop doctor called, explained the urgency without causing panic, and arranged immediate specialist consultation. The cancer they caught and treated early would have progressed significantly within months.

Dr. Mihir shares another pattern he’s noticed: “I’m treating entire families now. A young woman came to me with prediabetes after a routine health camp at her company. But I already knew her parents, both diabetic. I’d mapped the family’s metabolic patterns across generations. That context meant we could focus on prevention immediately, not wait for disease to develop. A hospital doctor could reach the same conclusion, but they’d need to start from scratch. I had the story already written.”

“That’s where Loop Health becomes ‘the doctor in the family,’” Dr. Mihir continues. “Over time, you stop seeing individuals in isolation and start caring for patterns, habits, and risks that run through households and across generations.”

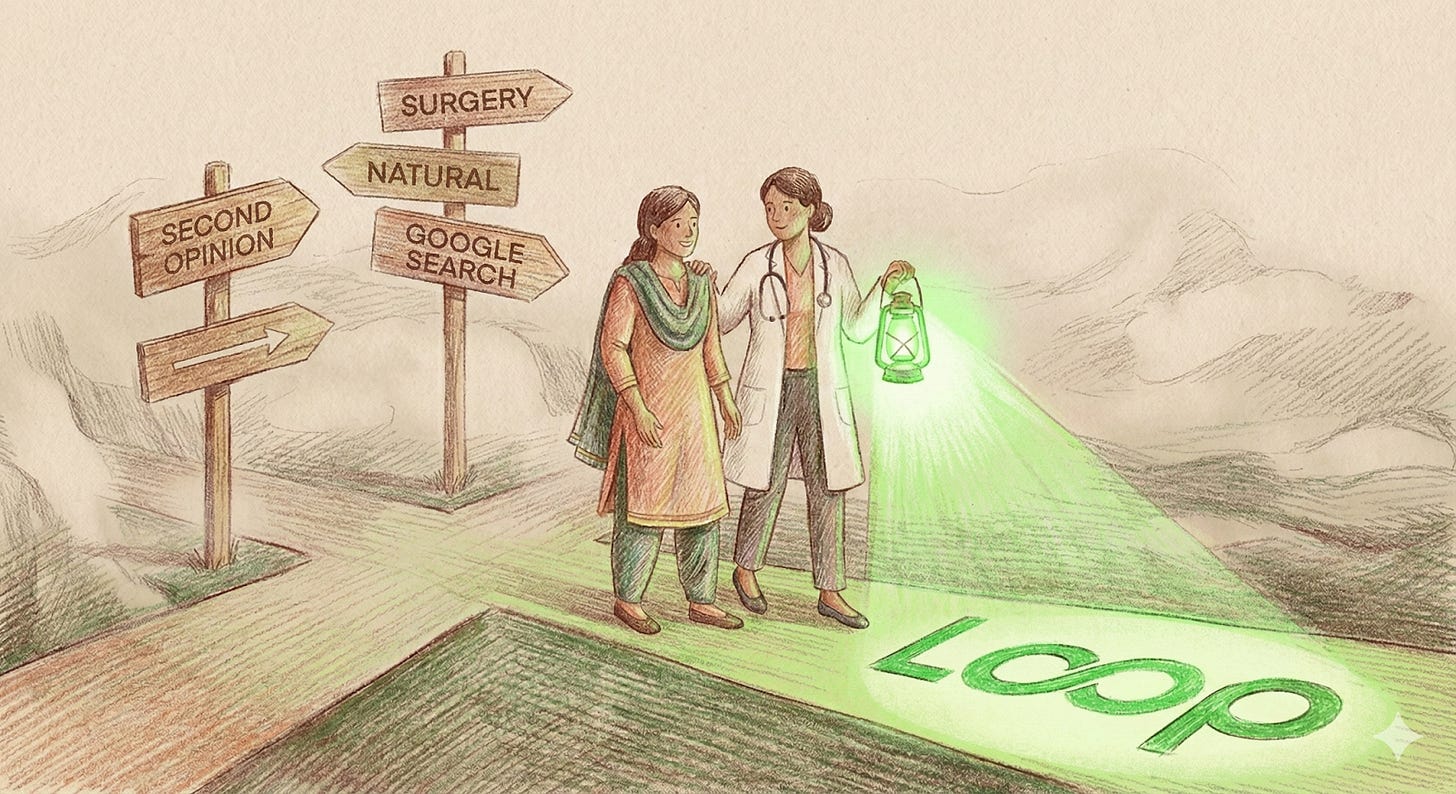

The most profound moments come in crisis navigation. Dr. Mihir recalls counseling an eight-month pregnant woman whose baby was breech, cord wrapped, low amniotic fluid. “Her OB recommended C-section. She was devastated because her family expected a natural delivery. We spent 40 minutes talking. Not pushing her toward or away from surgery, but explaining the medical reality clearly. She needed to make peace with the right decision, not the expected one. In situations like these, ethical care means respecting beliefs, but not at the cost of withholding clarity.”

The chronic cases reveal the system’s silent power. A Dengue patient, platelets dropping daily, messaging Dr. Priyadarshani’s team with each report. “Traditional insurance would cover hospitalization if it got bad enough,” she explains. “We monitored daily, adjusted treatment, kept them stable at home. They never needed admission.”

Dr. Priyadarshani’s team handles the sandwich generation’s unique burden daily. “Our MAs and doctors have access to the entire medical history of patients in an EMR. This becomes easier to navigate existing issues and help out the entire family at large. For example, if there’s a family of 5, employee (female), spouse, father, mother, one child, their consultation, medical, blood test history gets stored in updated real time. So if 4 months later the father, whom we assume is diabetic, comes in for a consult, the doctors already know which medicines he is consuming, when was the last test, etc. This ensures uniformity, consolidation, and most importantly, every family has a doctor in their family.”

Part 5: The Cracks and Edges

Loop Health’s infrastructure is impressive, but honesty demands acknowledging where it strains. The cracks appear not in the technology but at the intersection of India’s digital divide and healthcare’s inherent complexity.

“The first month with a new client is when the truth reveals itself,” Piyush explains. “On paper, everything always looks smooth. The client proudly walks in with a modern HRMS, the right people allocated, and an eager promise that ‘integration will be simple.’ But the moment we begin, the real story surfaces. Their product team is buried in other priorities. Approvals move slower than anyone expected. A clean API turns into an S3 bucket workaround. Technology is never the barrier; readiness is. So we step in, adjust the plan, sit with their teams, rewrite expectations together, and build momentum inch by inch.”

“Blue-collar workers often don’t have official email IDs,” Dr. Priyadarshani admits. “Even logging into the app becomes a challenge. The app is in English, but they’re comfortable in regional languages. They message us in Hindi, Tamil, Telugu and we translate and respond in their language, but it adds friction.”

The language barrier goes deeper during consultations. “When a factory worker needs a gastroenterologist who speaks Kannada, we might not have that specific specialty in that specific language available immediately,” she explains. “So our Medical Advisor joins the call, translating between doctor and patient. While we make sure nobody is left unheard, it does create a bit of a bottleneck because it adds one more step to the process.”

Piyush shares a moment of painful clarity: “A CHRO once told us, ‘You solved complexity but created paralysis.’ Their employees had beautiful options, but sometimes froze at decision time. Insurance is still a foreign language, and even smart employees can’t translate co-pays into real-life impact. This insight led us to build a recommendation engine that would act like a friend who knows your history, your family, and your risks.”

The virtual care model, for all its convenience, has natural boundaries. Dr. Mihir knows these boundaries intimately: “A middle-aged man called with chest pain, hoping for medication to get through the night. On video, he looked clammy, uncomfortable. Chest pain is where virtual care stops. You need an ECG, physical exam. I sent him to emergency. At the hospital, they found a cardiac event in progress. Sometimes the hardest decision is saying, ‘This needs to be seen in person.’”

Dr. Mihir also handles the modern challenge of information overload: “The question I get asked most is about these newer diabetes medicines everyone’s talking about as weight-loss drugs. Patients have Googled everything, seen celebrities’ results. What they ask isn’t ‘what is this drug?’ but ‘Doctor, can I take this?’ or ‘Will it work the same way for me?’ Google can’t answer that. These are judgment calls, not search results. People aren’t looking for Google to give answers, they’re looking for a doctor to say, ‘This makes sense in your case, and this doesn’t.’”

“Building a secondary and tertiary care network is a massive undertaking,” Ryan acknowledges. “Our investors are aligned and this is in our plans. We do suggest where to go, but providing data-informed suggestions that are rock-solid reliable, along with discounting, priority access, and quality control, these are the practical challenges. It’s just a question of when to pull the trigger.”

Part 6: Generation 4 And What Comes Next

“If I could kill one industry practice tomorrow,” Piyush says, “it would be the idea that everyone should get the same plan. This model was born when workforces were small, homogeneous, when benefits were compliance, not care. Today, it actively holds companies back. A young team ends up paying for maternity coverage they won’t use for years. A team with aging parents struggles with insufficient support. No one feels seen.”

Enter Generation 4: healthcare that shapeshifts around individual need. Not paternalistic (company decides everything), not purely transactional (employee alone in the market), but something new- employer-funded, employee-directed, Loop-delivered. This is what Loop calls “health assurance,” a category they’re creating because “insurance” no longer captures what they’re building.

The early results suggest something is working. Benefits enrollment jumped from 60% to 85% with HealthFlex implementation at Zepto. Employee complaints about benefits dropped significantly. Ola, BluPine, Livspace, Sharechat, Leadsquared, companies across sectors are seeing employees actually use their benefits before they’re sick enough to need hospitals.

“One client came in fully convinced their workforce couldn’t care less about benefits,” Piyush recalls. “Then enrollment opened. Within hours, employees were choosing plans reflecting their lives in intimate detail. A young couple expecting a baby chose maternity support. A mid-career employee added dental coverage she’d postponed for years. The same employees labeled ‘disengaged’ were making thoughtful decisions because someone finally spoke their language.”

The moment clients truly understand arrives without much fanfare. “A client sees their claims dashboard and notices how many cases closed without friction,” Piyush explains. “They see 97% satisfaction and pause. But the real turning point comes when they experience how the entire claims journey feels different. Each user has a dedicated claims advisor who knows their story. Our AI quietly checks every uploaded document for completeness, alerting both advisor and user instantly if something’s missing. The advisor calls, explains what needs fixing, and resubmits before the claim gets stuck. That’s when clients say, ‘This isn’t insurance support anymore. This is healthcare infrastructure.’”

“In 2030,” Ryan envisions, “employees will be excited for benefits enrollment because they’ll get what their family actually needs. I get the right insurance plan for myself and my family, basis our life stage and annual needs. The idea that we used to have one-size-fits-all benefits through our employer will seem really outdated. When I have a symptom or condition, I have a family medical concierge that will help me triage symptoms and get the right intervention. When I switch employers, I’ll be able to port my benefits. I’m in control of my medical records and can seamlessly move from one healthcare and insurance partner to another.”

But Ryan also acknowledges the operational challenge: “You have to be operationally excellent to execute this business. We work across and integrate with multiple insurers, TPAs, labs, radiology centers, wellness vendors. We have lots of customer endpoints: a mobile app, enrollment portal, clinical video calls, prescriptions, in-hospital claims assistance. It takes a healthy dose of customer obsession and deep respect for operational rigor and persistence to do what our teams do every day, and I’m really proud of them for that.”

Closing: The Morning After

6 AM. Shift change in Dr. Priyadarshani’s team. The night team hands over: hundreds of chats, dozens of consultations, 3 crisis interventions, 1 early cancer marker flagged, prescriptions renewed, 1 life saved from suicide. The day team takes over seamlessly because they can see every conversation, every prescription, every concern from the night.

“We’re proud because we’re the first point of contact,” Dr. Priyadarshani says. “Patients trust us. They believe we’ll help. And we have, thousands of times.”

The logs tell stories the benefits industry doesn’t track. An elderly woman in Mysore, alone at midnight, needing emergency care. The MA coordinating with the hospital, sharing locations, arranging consultations, ensuring doctors were ready when she arrived. Following up the next morning to check she’s okay.

“We work 24/7, 365 days, irrespective of weekends and festivals,” Dr. Priyadarshani reflects. “Yes, burnout happens. Maintaining response times, sitting for long hours, lonely night shifts. But as a medico, as a Medical Advisor, we have our own ways to cope up. We convert this lack of human interaction to conversations on huddles. It’s like another family where you discuss patients of professional life to patients of personal life. And I am proud to say that, for us everything comes second. First, the patients.”

Dr. Mihir captures what’s different: “If I went back to traditional practice tomorrow, I’d miss the time and freedom to really hear my patients. Every Loop consult is at least 20 minutes. Patients can fully explain concerns, ask questions, understand treatment without feeling rushed or worrying about costs. I’d also miss how easy it is to involve the right experts together. For a diabetic patient, I can bring in a nutritionist instantly; for a musculoskeletal case, a physiotherapist. But mostly, I’d miss the proactive approach. We’re not just treating problems after they happen; we’re helping prevent them. That human connection, the time, guidance, continuity, is what makes the difference.”

What genuinely surprised Dr. Mihir after joining Loop was the scale of the silent crisis: “People in their late twenties and thirties with central obesity, early insulin resistance, borderline cholesterol, poor sleep, high stress, almost no physical activity. Add vitamin B12 and D3 deficiencies, brushed aside as ‘minor’ but contributing to fatigue, poor concentration, long-term problems. In hospitals, we meet patients after damage occurs. Here, I see how routine screening and early intervention change trajectories before disease sets in. A small shift toward proactive healthcare can significantly change someone’s health and even their longevity.”

This is healthcare that operates on a different logic. Not “is it covered?” but “what do you need?” Not “submit and wait” but “let’s solve this now.” Not “your employer provides insurance” but “you have a doctor in your family.”

In a country where healthcare meant hospitals, where benefits meant hoping you never used them, where 50% of workers had no family doctor, Loop built something that shouldn’t exist: care that’s always there, never overwhelming, constantly learning what you need.

Their mission, adding 20 healthy years to India’s workforce, once seemed impossibly ambitious. But when you watch their infrastructure hum at 2 AM, see employees choosing mental health support over unused insurance, witness families navigating health crises with actual navigation support, you realize they’re not trying to revolutionize insurance.

They’re building the doctor India never had. The one who knows your family. Who answers at 2 AM. Who catches things early. Who treats budget waste as a moral failure, not a business model.

“Just offering wellness perks creates the illusion of proactive care while leaving chronic disease, diagnostics, and mental health unmanaged,” Ryan says definitively. “They serve more as a checkbox that the company is doing preventative health.”

The future of care in India might not be about better hospitals or cheaper insurance. It might be about never needing them in the first place. One wallet, one platform, one medical team at a time.

Justifies the name.

We all know how broken the Indian healthcare system is, and this is such a refreshing take! I cannot wait to see quantitative and qualitative outcomes of this model.