Selfies, SKUs, and WTF Happened to India's Influencer Brands?

Influencer-led brands should have been the easiest W of the century.

Think about it:

Built-in audiences? Check.

Storytelling chops? Check.

Distribution channels you literally own? Double check.

Globally, creators have turned these assets into billion-dollar empires:

Kylie Jenner's Lip Kits became a cosmetics juggernaut.

MrBeast sells more chocolate bars than Willy Wonka could dream of.

Logan Paul and KSI’s Prime Hydration had kids rioting in aisles like it was Black Friday.

Meanwhile in India?

We have millions of influencers — and not a single breakout D2C brand to show for it.

Not one Kylie. Not one Prime. Not even a moderately successful dupe.

Sure, a few merch drops. A skin serum here, a protein powder there.

But real brands? Sustainable, category-owning brands that sell beyond a fandom moment?

Nope.

India’s creator economy is booming on the surface. The number of influencers in India exploded from under 1 million in 2020 to over 4 million by 2024. Brands are pouring marketing spend into influencer collaborations, driving an industry projected to reach around ₹3,375 crore (∼$400 million) by 2026. E-commerce is steadily rising too- online retail now makes up about 8% of India’s total retail market (up from 4% in 2018). Yet these trends haven’t translated into homegrown influencer mega-brands. Indian social media stars boast huge followings and engagement, but when it comes to launching and scaling their own direct-to-consumer (D2C) product lines, they’ve largely fallen short. Why are Indian creators struggling to build brands that rival those in the U.S. or even the Middle East? And more importantly, what will it take to crack the code?

India’s Influencer Goldmine Meets Harsh Market Realities

Before looking at individual brands, it’s crucial to understand the playing field in India versus more mature markets. On paper, India’s influencer and e-commerce landscape seems ripe for creator-led brands: the country is one of the fastest-growing social media markets, with over 467,000 influencers having 100k+ followers by 2024. Total content creators (including micro-influencers) run into the millions. Meanwhile, online shopping has become mainstream, accelerated by Jio’s cheap data and the COVID boom. India’s annual transacting e-retail shopper base reached an estimated 230-250 million people in 2023, more than double what it was just three years prior. These are massive numbers, second only to China in scale.

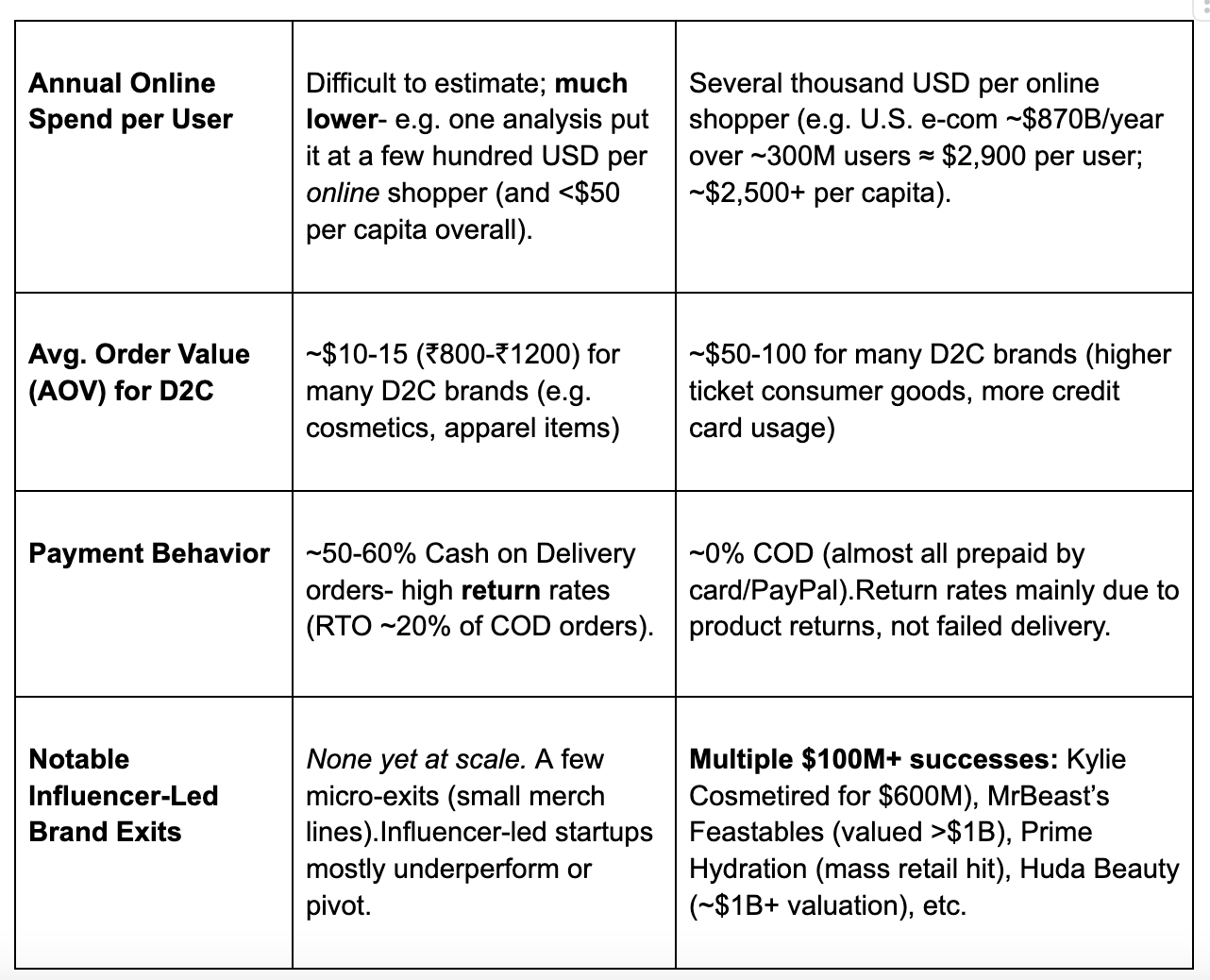

However, aggregate numbers hide the reality of limited purchasing power. India’s GDP per capita is only around $2,700 (nominal), compared to about $85,000 in the United States. That 30x gap in average income translates to far lower disposable spending for the Indian consumer. The average Indian follower can’t splurge on influencer-branded products the way an American consumer can. Even the middle class in India is cautious: discretionary spending is growing, but from a low base. For instance, online spending is still only 5-6% of total retail in India vs ~23-24% in the U.S.. In absolute terms, India’s $60 billion e-retail market in 2023 is a fraction of the U.S. e-commerce market (which exceeds $1 trillion). It’s no surprise, then, that a creator like Kylie Jenner could sell $50 lip kits by the truckload in the U.S., whereas an Indian creator’s audience might balk at similar price points.

Beyond income, behavioral differences shape the market. A huge share of Indian e-commerce runs on Cash on Delivery rather than prepaid orders. As of recent years, an estimated 60-70% of online orders in India were paid via COD, especially in Tier 2-3 cities. This has a nasty side-effect: very high RTO (Return to Origin) rates, where customers refuse or return the package at delivery. Industry data shows that while average online return rates globally are ~20%, it climbs to 40% for COD orders in India, meaning nearly half of COD shipments can boomerang back to the seller. For any D2C brand, that’s a huge erosion of margins and a forecasting nightmare. An influencer-launched product that relies on hype purchases could see a big chunk of orders never actually convert to revenue due to COD returns. In contrast, markets like the U.S. have ~16% e-commerce share of retail, with almost all orders prepaid by card or digital wallet, and return rates (while high in apparel) don’t usually include outright refusal to pay.

Another structural factor is logistics and infrastructure. India’s delivery networks have improved, but outside metros, the D2C logistics experience is still rough. Shipping can take 5-7 days to smaller towns, tracking is less reliable, and the cost of delivery as a percentage of order value is high. India’s overall logistics cost is around 13-14% of GDP, nearly double the efficiency of developed countries. For consumers, this often means slower deliveries and more friction (which further feeds into COD preference- people want to see the item before paying). For brands, it means thinner margins and the need for cash-intensive inventory and fulfillment capabilities to ensure a good customer experience nationwide. In the U.S., Amazon’s Prime has trained shoppers to expect 1-2 day delivery almost anywhere; an Indian D2C brand simply can’t match that out of the gate. These infrastructure gaps make it harder for an influencer brand to delight customers consistently, beyond the initial fan-driven purchase.

Perhaps the biggest difference is audience profile and trust. Indian influencers often cultivate very broad followings- a top comedy creator or fashion blogger might have fans ranging from metro teenagers to homemakers in small towns. The upside is mass reach; the downside is heterogeneous taste and limited niche depth. A comedy skit influencer may not have the credibility to sell, say, fitness supplements or high-end cosmetics to all their followers. By contrast, many Western creator brands sprouted from niche authority: Huda Kattan was a beauty expert whose followers trusted her makeup recommendations. MrBeast had a reputation for over-the-top generosity that lent itself to a fun food brand. In India, it’s common to see influencers pivoting to categories unrelated to their content persona, which can confuse consumers. Moreover, years of heavy #ads and sponsorships on Indian social media have started breeding follower fatigue. Audiences can tell when a recommendation is just a paid partnership versus something authentic. Declining engagement due to the oversaturation of promotional content is making brands (and fans) more skeptical of influencer endorsements. When an influencer who regularly pushes myriad brands suddenly says, “buy my own brand,” some followers roll their eyes. Trust, once diluted, is hard to reclaim for driving sales.

In summary, Indian influencers operate in a market where consumers are plentiful but spend little, where cash dominates and returns are rampant, where delivering a product is costlier and slower, and where audience trust has been tested by an onslaught of sponsorships. It’s a far cry from the relatively affluent, digital-payment, niche-driven environment that powered many Western creator brands. These headwinds don’t mean influencer-led brands can’t work in India, but they do mean the formula for success has to be adapted and executed with far more operational rigor.

A painful TL;DR:

Billion-Dollar Playbook: How Global Creators Built Thriving Brands

Despite the challenges in India, it’s instructive to study the global influencer brands that succeeded in markets like the U.S. and UAE. These cases show what’s possible when a creator leverages their platform to launch a product with the right market fit, strategy, and execution. I’m diving into 4 example I found striking: Kylie Cosmetics, Huda Beauty, Prime Hydration, and Feastables. Each hit real scale, but via different paths. The common thread is that these creators treated their brands as serious businesses from day one, combining the power of their celebrity with solid products and savvy go-to-market tactics.

Kylie Cosmetics

When Kylie Jenner launched her first $29 “Lip Kits” in 2015, powered by nothing but her social media hype, they famously sold out in minutes. By 2018, just three years in, Kylie Cosmetics’ annual revenue was around $360 million. In late 2019, beauty conglomerate Coty Inc. acquired a 51% stake for $600 million, valuing Kylie Cosmetics at $1.2 billion. That transaction cemented Kylie’s status as (at the time) the youngest self-made billionaire and proved the commercial potency of influencer-driven brands.

How did Kylie do it? Several factors stand out:

Scarcity-driven hype: Kylie leveraged drop culture by releasing limited batches that drove frenzied demand and constant sold-out headlines.

Social media funnel: she had 100M+ Instagram followers by then and marketed directly to them with personal content, effectively making her Instagram a storefront. There was authentic alignment. As a fashion/beauty trendsetter, her audience saw her as a natural authority on cosmetics (it helped that the signature “Kylie lip” look was a viral craze unto itself).

She kept the operation lean and digital-first: early on, Kylie Cosmetics was almost exclusively sold online (and later through an exclusive partnership with Ulta Beauty in stores), which kept distribution efficient. By owning the customer relationship directly through social channels, the brand barely needed traditional advertising.

A key lesson here is the power of a hero SKU and FOMO: one great product that embodies the influencer’s persona can be more valuable than a full catalog. Kylie expanded into other makeup, but only after dominating the lip category.

Huda Beauty

Around the same time, another influencer-turned-entrepreneur was building a cosmetics giant, not in Los Angeles, but in Dubai. Huda Kattan, an Iraqi-American makeup artist and beauty blogger, founded Huda Beauty in 2013, starting with false eyelashes she sold through Sephora in the Middle East. Thanks to her hugely popular beauty blog and Instagram tutorials, Huda’s products gained cult status among makeup lovers. By 2017, Huda Beauty was reportedly valued at over $1 billion (she sold a minority stake to private equity by then). While exact revenue figures aren’t public, one estimate pegged sales around $200+ million by 2018. As of today, Huda Beauty is a global cosmetics brand stocked by major retailers and often mentioned in the same breath as legacy brands.

Huda’s success underscores the importance of domain expertise and trust.

She spent years building a following by giving genuine beauty advice, reviewing products, and demonstrating looks. By the time she launched her own line, followers trusted that Huda knew good makeup.

Her first product (false lashes) filled a gap: high-quality glam lashes that weren’t easily available in the Middle East market at the time.

As an influencer, she focused on inclusive marketing: Huda Beauty was known for catering to all skin tones with its foundations and for imagery that resonated with the local audience. This was a differentiator vs. Western brands.

The brand’s growth also benefited from a hybrid model: strong D2C e-commerce plus traditional retail partnerships (Sephora, etc.), which gave it global shelf presence.

Notably, Huda built a community around her brand; her content and personality remained a central marketing asset (she often appeared in product videos and remained the face of the brand). Unlike some celebrity lines that slap a name on white-label products, Huda Beauty was perceived as Huda’s own creation, born out of her passion and knowledge.

For Indian context, if an influencer can corner a specific niche (beauty, in her case) and deliver a product that matches pent-up local demand, the sky’s the limit. It also helps to have a market like the UAE with high spending power, something to consider when comparing to India.

Prime Hydration

What happens when two of the world’s biggest YouTube/Instagram stars collab on a physical product? In the case of Logan Paul and KSI’s Prime Hydration drink, you get explosive growth that even legacy beverage companies envy. Prime, a sports hydration drink launched in January 2022, took off like a rocket, fueled entirely by the creators’ enormous fanbases and online theatrics. By late 2023, Prime had already sold over 1 billion bottles and reached $1.2 billion in sales, an astonishing achievement in under two years. It became so popular, especially among Gen Z, that it sparked reselling frenzies in the UK and was named the official sports drink of the UFC. To put it in perspective, Prime’s revenues in 2023 likely rivaled those of Gatorade in some markets- a testament to how quickly influencer hype can translate into real-world dollars if harnessed right.

Prime’s playbook was different from beauty brands: it’s a high-volume, lower-priced FMCG product (a hydration drink priced around $2), meaning success relied on hitting massive scale.

Logan Paul and KSI executed on this by employing viral marketing stunts and relentless promotion: They announced Prime jointly to their combined 100+ million followers, immediately creating a crossover appeal (American and British audiences). They pushed the product in their content- from YouTube videos to boxing match sponsorships.

Scarcity again played a role: in the UK, limited drops of Prime led to such demand that bottles were being resold for £20-30 and stores ran dry. This scarcity was partly organic (supply struggled to keep up), but it only made the hype bigger.

Prime also smartly expanded offline fast: They landed deals with Walmart, Target, and major supermarkets to get nationwide availability, which many influencer brands hesitate to do initially. This meant kids could actually buy it easily once they’d heard of it online. In effect, Prime created a feedback loop: online hype -> offline sales -> social media chatter (with photos of empty shelves, etc.) -> more hype.

The product itself, a flavored coconut-water-based sports drink, rode the trend of healthier energy drinks (zero sugar, for instance), aligning with what teen consumers wanted.

Crucially, both Logan and KSI treated Prime as a serious venture, not just merch: They likely had a professional beverage team formulating and managing operations (Prime is produced by a company that sources and bottles the drink, not by the YouTubers personally in a kitchen).

The lesson here is to think big and move fast: Prime didn’t linger as a niche D2C offering; it leveraged the influencer megaphone to become a mainstream product within months. For Indian creators, the notion of two big influencers partnering to launch a product for a mainstream audience (and saturating retail channels) is intriguing- it hasn’t really been attempted at comparable scale. Prime shows that influencer products need not remain “online-only” or niche; if demand is there, they can go toe-to-toe with legacy brands in traditional channels.

MrBeast’s Feastables

Jimmy Donaldson, better known as MrBeast, is arguably the world’s largest YouTuber (over 240 million subscribers across channels). In 2022 he decided to get into the snack game with Feastables, a line of chocolate bars and snacks. True to MrBeast’s style, Feastables launched with a Willy Wonka-esque golden ticket contest and a promise of better ingredients (the bars are simpler, “healthy” chocolate). The result: the bars sold out almost immediately upon release, and within months, Feastables secured nationwide distribution in Walmart’s 4,700 stores. By 2023, you could find Feastables chocolates in nearly every U.S. state, often in dedicated MrBeast-branded retail displays. While revenue numbers haven’t been publicly released, the brand reportedly did tens of millions of dollars in sales in its first year and has expanded into cookies and other snacks. MrBeast even raised venture funding for Feastables and continues to heavily integrate it into his content (e.g., videos giving away Feastables or challenges involving the bars).

Feastables’ success is a masterclass in community engagement and gamified marketing:

MrBeast essentially turned buying his chocolate into a participatory event: fans could win prizes (even a chocolate factory tour, in a nod to Willy Wonka) and were encouraged to share their purchases on social media. This created viral social proof- fans posting “I got my Feastables bar!” which in turn drove others to want to join the fun. It wasn’t just candy; it was an experience tied to the MrBeast brand of over-the-top giveaways.

The product also aligned with his audience, primarily young, internet-savvy people who love a good internet trend.

MrBeast also leveraged his existing brand equity masterfully: after years of giving away money and doing philanthropic stunts, his fans genuinely want to support him (many see buying his products as a way to “give back” for all his free content). This goodwill meant minimal skepticism about quality

From a business standpoint, Feastables hit a sweet spot in pricing and category: it’s affordable (~$3 per bar), repeat-purchase friendly, and fits in a grocery budget. Unlike a pricey gadget, chocolate can be impulse-bought by a wide range of people. And MrBeast’s reach ensured that even a small conversion of his audience meant huge sales- for example, if just 5% of his YouTube subscribers bought a $10 bundle of bars, that’s $12 million right there.

The Feastables story emphasizes scarcity, social proof, and having an actually good product. The bars initially selling out created that same aura of “must have” that others on our list employed. Fans posting their experiences yielded FOMO in others who hadn’t tried it yet, driving them to order before it “sells out again.” And fundamentally, the product delivered on what was promised (fun packaging, good taste, simple ingredients), so people came back for more after the hype. It also underlines that engaged community > sheer follower count: MrBeast mobilized his fans; not every influencer with similar reach could do the same unless they’ve built that rapport.

The Indian Influencer Brand Landscape: Launches Without Scale

With the bar set by global examples, let’s examine what’s happened in India so far. In recent years, a number of Indian influencers have tried their hand at launching brands. A few notable attempts include:

Youthiapa by Bhuvan Bam (BB Ki Vines): Bhuvan Bam launched Youthiapa, a casual apparel and merchandise brand, around 2017. Initially it was mostly fan merchandise (t-shirts, caps with his channel’s slogans). The launch saw strong fan response, but Youthiapa largely remained a merch venture and did not evolve into a broader youth fashion brand accessible beyond his fanbase. It had momentum but limited scale, and a few years on, it’s not a household D2C name beyond Bhuvan’s core followers. The trajectory was more akin to a celebrity merch line rather than a standalone high-growth startup.

Skincare and Beauty Brands by Influencers:

Indē Wild by Diipa Khosla: A standout example in terms of ambition, this Ayurvedic-inspired skincare brand was launched in 2021 by Diipa Büller-Khosla. Indē Wild consciously tried to blend Ayurvedic ingredients with modern formulations (“Ayurvedistry”), targeting both Indian and global markets. The brand gained traction online, especially among women interested in clean beauty. Indē Wild recently raised $5 million in funding led by Unilever Ventures to fuel international expansion. Diipa reported the brand achieved 400% year-over-year growth in India and even “sells one unit every minute in 2024”, making it one of the fastest-growing premium brands on platforms like Nykaa. While still far from the scale of a Kylie Cosmetics, Indē Wild shows that an influencer brand can attract serious investors and scale rapidly if positioned well (in this case, tapping into the global Ayurvedic trend with a founder who is herself a cross-border personality). It remains to be seen if Indē Wild can break into the big leagues, but its early success is a positive sign.

Kay Beauty by Katrina Kaif: Although Katrina Kaif is a Bollywood actress (not an organic “influencer”), her makeup line Kay Beauty (launched in partnership with Nykaa) leveraged her social media presence heavily. It has done reasonably well in Indian e-commerce. This is a celebrity brand, but its marketing playbook- heavy Instagram promotion, tutorial videos by Katrina- mimics influencer brands. It highlights that even A-list celebs haven’t cracked a unicorn outcome in D2C yet (Kay Beauty is popular but not dominating the market).

Other beauty launches: We’ve seen influencers like Shreya Jain (beauty YouTuber) collaborate on makeup collections, or brands like MyGlamm run influencer-driven product lines (e.g., a lipstick shade created by an influencer). Most of these are collaborations rather than standalone creator-founded companies. They often flare up during launch (as the influencer pushes it for a few posts) and then fade away or become a small part of a larger brand’s catalog.

Fashion and Apparel by Influencers:

Dee Clothing by Deeksha Khurana: A fashion influencer, Deeksha, started her own clothing label focusing on trendy apparel. It garnered initial interest from her followers. But scaling a fashion brand involves inventory, sizing, seasonality- basically, many moving parts. Dee Clothing has stayed relatively niche, mostly selling via Instagram and a website, without expanding to mainstream recognition or large-scale retail.

Generally, outside of celebrity designers (Masaba Gupta, for instance, who is more a designer-entrepreneur than an “influencer”), we haven’t seen an influencer fashion brand become a nationwide hit. The market is crowded with D2C apparel brands and requires differentiation beyond the influencer’s style.

UnderNeat by Kusha Kapila: A shapewear brand founded by Kusha Kapila, UnderNeat aims to be the Indian answer to SKIMS (Kim Kardashian’s famous shapewear line). The brand positioned itself as affordable yet quality shapewear for Indian body types, priced about 30-40% lower than imported options. Kusha used her platform to create buzz, discussing body positivity and the need for good innerwear, effectively warming up her audience before the product drop. The launch generated a lot of noise on social media and initial sales seemed strong (her announcement post got huge engagement, and the site saw heavy traffic). However, the true test will be scaling beyond the first collection. Shapewear is a challenging category in India- it requires educating consumers and convincing them to pay for essentially an “invisible” garment. UnderNeat’s early reception was positive, and Kusha’s content certainly gave it a boost. But as a creator-founded startup, it faces the typical D2C hurdles: supply chain, sizing feedback, returns (especially for innerwear, fit issues can cause returns), and expanding the product line smartly. It’s too early to call UnderNeat a success or failure, but it stands as a high-profile case of a content creator stepping directly into entrepreneurship.

There’s been no shortage of influencer “launches,” but nothing that’s truly lasted or scaled to tens of millions of dollars in revenue. We’ve seen apparel and merch lines that plateau, beauty brands that make a splash but remain niche, and newer experiments in other categories that are promising but early-stage. Unlike in the U.S., where creator brands like Kylie’s or Prime became market leaders in their categories, we haven’t seen an influencer brand crack even the top 5 of any major consumer category.

So, why this gap? Why, with millions of followers at their disposal, have Indian creators not built a single ubiquitous consumer brand? The reasons tie back to the structural challenges touched on earlier, and some unique mindset issues as well. Let’s break down the core problems impeding influencer ventures in India:

The Structural Challenges Holding Back Indian Creator Brands

1. Low Disposable Income & Price Sensitivity: Simply put, Indian consumers (especially the mass of followers outside Tier-1 cities) are extremely price-conscious. It’s hard to build a premium brand off a mass influencer audience here. A creator with 10 million followers might find that 8 million of them are students or lower-middle-class individuals with limited ability to buy non-essentials. So if the creator launches, say, a skincare serum at ₹1200, how many of those fans will actually convert? A tiny fraction. To move volume, pricing often has to be low, but low pricing then demands scale to be profitable, a Catch-22 for a new brand. Internationally, influencer brands often target a premium niche (Kylie’s $29 kits, Huda’s high-end palettes, Prime is an exception targeting mass, but did so in a rich market). In India, hitting the right price-value equation is incredibly challenging. Creators either go too high (and get few sales, mostly from their affluent metro fans), or go cheap (and then struggle to maintain quality and margins, leading to a subpar product that dies out). The economic reality is that until India’s GDP per capita rises closer to that $4,000 threshold where discretionary spend explodes, influencer brands either need to cater to an elite segment or somehow create a value product with broad appeal. Few have managed this balance. Most influencer-launched goods so far have effectively been boutique offerings for the top 5% fans.

2. Trust Deficit from Over-Commercialization: Indian audiences are increasingly wary of influencer recommendations. Over the past 5 years, influencer marketing in India went from novelty to ubiquitous- every other post is a paid partnership for some shampoo or fintech app. This has eroded the blind trust that early influencers enjoyed. Consumers now often view influencer pitches with the same skepticism as an ad. So when an influencer pushes their own brand, many followers might assume “oh, they’re just trying to cash in on us” unless proven otherwise. In contrast, a creator like MrBeast had cultivated a different kind of trust (he gave money away, rarely did conventional sponsored posts, so when he sold something, fans believed it was for a good cause/honest). The Indian influencer scene needs to course-correct on authenticity if creator brands are to thrive. If audiences even sniff that an influencer’s heart isn’t 100% in it (e.g., they keep doing unrelated ads on the side, or the product seems generic), they disengage. Unfortunately, many early influencer products felt half-baked- more merch than mission-driven brand- and that has trained consumers to be skeptical. Regaining that credibility will require influencers to dial up authenticity and dial down the constant #ads for other brands, which is a short-term income sacrifice some aren’t willing to make.

3. Broad vs. Niche Audience Mismatch: As mentioned, a lot of Indian influencers have very broad appeal, which paradoxically can be a weakness for launching a product. For instance, a comedian who does skits in Hindi might have 15 million followers ranging from 15 to 35 years old, male and female, across metros and small towns. It’s tough to identify a single product category that resonates with that entire base. If he launches fashion streetwear, maybe 20% of those fans care (the young, style-conscious segment). If he launches a tech gadget, another slice cares. Essentially, the effective reachable market from that 15M may only be a couple million at best for any given product. In India, some of the biggest “influencers” come from comedy, Bollywood dance, general lifestyle- great for eyeballs, not so straightforward for targeting a product. The influencers who do have niche clout (tech reviewers, beauty gurus, gamers, etc.) typically have smaller followings (in the low millions or hundreds of thousands). They could still launch brands (and perhaps they should try more), but the culture of entrepreneurship hasn’t caught on as much in those circles yet. So there is a bit of a white space: the ones with reach don’t have focus; the ones with focus don’t have reach.

4. COD and the Nightmare of RTO: Cash on Delivery is both a boon and bane in India. It boosts order conversion (people who don’t want to pay upfront will still order), but it introduces huge friction: returns, canceled orders, and working capital lockups. For a fledgling D2C brand, high RTO can be fatal. Imagine you ship 1000 orders, but 300 come back unaccepted- you’ve lost shipping cost both ways, products are stuck, some may come back damaged, and your real conversion rate was only 70% of what you thought. The cost of those failed orders eats into the profit from successful ones. Many Indian D2C brands report 20-30% RTO rates on COD as common, and it can spike higher for certain regions. Influencer-driven orders might be even more prone to RTO if the purchase was impulsive during a drop (some fans click buy then later change mind or don’t have the cash when courier arrives). Also, logistics partners often take longer to deliver COD parcels because they batch them, leading to impatient customers refusing delivery. All this means thinner effective margins and the need for more working capital to absorb the shocks. In the West, D2C brands largely get money upfront (credit cards) and deal mostly with legit returns (product dissatisfaction) which are lower. In India, a huge chunk of “returns” are just failed cash deliveries, which is wasted effort. This makes the D2C model tougher unless one actively manages it (with tactics like small COD fees, confirmation calls, partial upfront payment, etc., which add friction and cost). Influencer founders who aren’t deeply familiar with these nitty-gritty issues can get very frustrated as their exciting launch devolves into fighting fires in the courier network.

5. Immature Ops, Supply Chain & Customer Service: Building a brand is not just about the idea and marketing, it’s about execution. In India, the ecosystem for D2C (while growing) is not as plug-and-play as in the U.S. There, a creator can find turnkey solutions: a high-quality private label manufacturer, a 3PL fulfillment center that ships in 2 days, Shopify for tech, Klarna for payments, etc. In India, some of these exist, but quality varies. If an influencer doesn’t pair with a strong operational co-founder or team, they will hit a wall in scaling. We’ve heard of many “Instagram brands” suffering issues like stockouts for weeks, poor quality in later batches due to supplier changes, customer complaints not being answered, etc. These damage reputation fast. The influencer’s native strengths (marketing, storytelling) can take a brand only so far. Eventually, supply chain and business fundamentals decide if it survives. Many Indian influencer ventures may have faltered after the initial spike because they didn’t shore up these fundamentals. Without robust operations, even a great product idea will collapse under growth. Unfortunately, running a tight ship in D2C in India is just hard. One has to navigate unreliable manufacturers, logistical bottlenecks, and frugal consumers. It’s doable (we have plenty of successful D2C startups now), but those startups usually have experienced founders or investors guiding them. Influencers diving in without that support structure likely learned harsh lessons and lost momentum.

6. Short-Term Mindset (Launch and Leave): A critique often levied at influencers is that they may not treat the brand as a long-term endeavor. Many are excited by the idea of launching a brand (“My own brand!”) but underestimate the grind needed to scale it over years. They might push hard during launch month, then as challenges emerge, their attention shifts back to their primary career (content, acting, etc.). The brand then languishes. This is partly a mindset issue and partly bandwidth- most top creators have many opportunities and may not prioritize a business that doesn’t take off immediately. But building a brand is a multi-year play. The global successes we discussed took a few years to hit full stride (and the founders remained heavily involved). If Indian influencers treat brand launches as side projects or as quick monetization plays, they will inevitably fizzle. Audiences can sense it too. If the creator stops talking about their brand after a while or isn’t iterating new offerings, customers lose interest. To date, few Indian influencer brands have shown the consistency and persistence needed. This again ties to incentive alignment: if the influencer doesn’t have significant “skin in the game” or if it was a collab where they got a one-time payout, their motivation to slog through tough times is low. The outcome is many one-season brands that fail to build on early adopters and never achieve product-market fit at scale.

It might sound bleak, but understanding these challenges is the first step to overcoming them. None of them are insurmountable. In fact, they point to exactly what not to do when building an influencer-led brand in India. With the right strategy and execution, creators can navigate around these pitfalls. India’s consumer market, while currently lower spending, is growing rapidly; trust can be rebuilt with authenticity; operations can be bolstered by partnering with experienced folks; and niches within the broad audience can be targeted smartly. The gap is real, but it’s also an opportunity- no influencer brand has “owned” this space yet, meaning the first few who get it right can define the category and enjoy outsized gains.

Before we go ahead…

Should You Even Build a Brand? A Quick Litmus Test:

Do you have domain authority beyond just reach?

Can you afford 12–18 months of operational headaches?

Are you willing to skip easy brand collabs in the short term to build your own?

Can you narrate and operate?

If not, maybe focus on content. Not every creator has to become a founder. And that’s fine.

Cracking the Code: A Playbook for Indian Influencer-Led Brands

If an influencer came to me as a prospective investor OR cofounder and said, “I want to launch a brand and make it big in India,” this is exactly what I would tell them:

1. Start with a Hero Product That Solves a Real Need

Don’t launch with a whole 50-SKU catalog; focus on one (or a very small number of) hero product(s) that you knock out of the park. Identify a genuine gap or need in the market that aligns with your persona. This product should be something you can unabashedly hype as the best in its class. By concentrating your energy, you ensure quality and can create a singular narrative. For example, if you’re a skincare influencer constantly asked about acne solutions, maybe your hero product is a targeted pimple potion. If you’re a gamer influencer, maybe it’s an energy snack for gamers. The key is product-market fit- your product should fulfill a clear desire of your audience, not just be a vanity project. Your hero SKU must embody a promise you made to your audience- of them owning a piece of your story, your persona- and deliver. Having a hero product also makes it easier to execute scarcity and to get known for something rather than many mediocre things.

2. Create Scarcity-Driven Drops and Hype Cycles

Leverage the power of FOMO that we’ve seen work globally. Rather than dumping steady stock that sits around, use a drop model, especially in the early days. This means releasing limited batches or new variants in controlled quantities and marketing them as special events. Scarcity does a few things:

it concentrates demand (everyone rushes at once, boosting your sell-out chances and social media trends)

it makes customers feel lucky to get one (boosting word-of-mouth as they show it off),

it protects you from overproducing inventory before demand is proven.

For instance, plan your launch like an “event”- build anticipation for weeks, maybe have an “early access” for your core fans (e.g., via a secret link or code for your YouTube subscribers), and then drop a limited quantity. If you sell out in minutes or hours, don’t view the inability to satisfy all demand as a loss- the buzz you generate is worth it. People always want what they can’t easily have; next time even more will show up.

However, one caution: scarcity should be genuine, not a gimmick. If you claim limited edition, keep it limited. You can do frequent drops (monthly small batches) rather than having product always “in stock.” Streetwear brands and sneaker companies have mastered this- there’s no reason influencer brands can’t. Build hype, release, sell out, pause, then repeat, each time learning and scaling inventory carefully. This approach also helps manage COD risk a bit (limited orders at a time) and gauges true demand.

3. Price it Right & Offer Value (Don’t Just Premium-Price on Name)

This is especially important in India’s price-sensitive market. Your fans might love you, but their wallet speaks louder. You have to be very strategic in pricing. Two models can work:

premium but justified (if you’re targeting a smaller affluent segment with a truly superior product),

mass-affordable with high value (targeting volume).

What doesn’t work is a mediocre product at a premium price just because your name is on it.. Indian consumers will simply opt for a cheaper alternative unless they see clear value. Do your homework on pricing similar products in the market. If you’re launching a shampoo, for instance, decide if you’re playing in the salon-grade range or the Sunsilk range- and ensure everything (formula, packaging, marketing) aligns to that. In many cases, it might be smarter to go slightly above mid-market: not cheap, but not exorbitant, basically an affordable luxury or aspirational value product. This way, your loyal fans can stretch a bit to afford it, and you still maintain some premium appeal. Also, consider offering starter sizes or kits at lower entry prices, so curious followers can try without a big commitment. For example, a mini lipstick or a trial pack of your coffee. Once they like it, they’ll invest in full-size. The idea is to reduce barriers to trial. Remember, unlike a traditional brand, you have the advantage of a built-in audience willing to try- but don’t squander that goodwill by making it financially hard for them to do so. Better to earn a smaller amount from many fans (and then upsell them) than to have only a few rich fans buy while others watch from the sidelines.

4. Partner with Operational Experts and Get Your Hands Dirty in Ops

If you’re an influencer, acknowledge what you don’t know.

Surround yourself with people who know how to build brands behind the scenes. This could mean co-founding with someone who has led a supply chain or e-commerce team, or hiring an experienced COO early, or partnering with a company that provides D2C brand incubation. Be wary of arrangements where you’re only the face and some third-party handles everything- you might lose control over quality and brand direction. Instead, be actively involved but lean on expert advice. For instance, get a good manufacturer (visit the factory if you can), invest in a solid website/tech setup (a glitchy site on launch can kill your momentum), set up customer service channels from the get-go (even if it’s just a small WhatsApp support team- fans will have questions/feedback and responding promptly builds trust).

Plan for logistics and returns: use address verification tools, maybe demand OTP confirmation for COD, consider partial or full prepayment incentives (like give a 5% discount for prepaid orders to encourage that). These small operational tweaks can save a lot of headaches. Essentially, treat this as a startup, not a merchandise fling. That means tracking metrics (conversion rates, return rates, customer acquisition cost if you run ads beyond organic reach, repeat purchase rates, etc.) and iterating the same way a non-influencer founder would. Influencers bring a lot of X-factor, but the brand must ultimately stand on fundamentals of quality, availability, service, and value.

In India’s context, a “hardcore ops focus” might be the single biggest factor that separates a flash-in-the-pan drop from a sustainable brand. It’s not sexy, but operations is where the magic happens that customers never see. If you’re not prepared to either dedicate yourself or someone trusted to supply chain, warehousing, delivery, and product refinement, better not to start at all. Conversely, if you do nail ops, it becomes a competitive advantage because many others don’t in our market.

5. Align Incentives: Put Skin in the Game for Everyone Involved

One reason many influencer ventures fizzle is misaligned incentives. The influencer gets a big payout upfront or retains an outsized equity without contributing to growth, or a partner agency is just paid a fee and doesn’t care about long-term results. To succeed, structure your venture so that key players win only when the brand wins. If you’re partnering with an investor or platform, perhaps agree that you as the creator only earn substantial returns when certain sales milestones are hit (beyond a modest base salary). Conversely, ensure you retain meaningful ownership so you remain motivated to push the brand for years, not just a quick buck. If bringing on a co-founder or hiring top talent, consider giving them equity or profit share- you want them as invested as you are in making this huge. Essentially, adopt a startup mindset of shared upside and downside. For example, if an influencer collaborates with a manufacturing company, negotiate a lower base cost in exchange for a percentage of revenue sharing, so the manufacturer is motivated to maintain quality and scale production efficiently for mutual benefit. When incentives align, the team will weather storms together. When they don’t, people abandon ship at the first sign of trouble. As an influencer, putting your own skin in the game (financially and reputation-wise) also signals to your audience that you truly stand by the brand. If you have investors, choose ones who are in it for the long haul and understand the creator economy, not just any money. A cap table with patient capital and a founding team with equitable stakes sets the stage for patient growth, which is needed in India.

6. Build a Community, Not Just a Customer Base

One superpower of influencer-led brands is the built-in community feeling. Cultivate that actively. Don’t treat people as one-time buyers; turn them into a community of brand advocates. Leverage your content skills to keep them engaged beyond transactions.

Create a private Instagram account or WhatsApp group for customers where you drop new updates or solicit feedback.

Encourage user-generated content- repost customers’ photos using your product (this not only flatters them, it provides social proof to others).

Run challenges or contests that involve the product (like “style this top in your unique way and win a shoutout” or “recipe contest using our health mix”).

Essentially, make your followers feel like co-creators in the brand journey. This drives loyalty and organic growth. When you involve your audience in decisions (poll them on new flavors or colors), they feel invested in your success. Global brands like Glossier (though not influencer-founded, it grew from a beauty blog community) showed how powerful a community can be in scaling a brand with almost zero traditional marketing. In India, community-building is an area many D2C brands underutilize, but influencers are masters of building communities (that’s what a following is!). So extend that approach. Don’t stop at selling a product; continue the two-way conversation. An excited community also becomes a moat against bigger competitors- your fans will stick with your product even if others copy it or sell it cheaper, because they are emotionally connected. For example, if you start a monthly live session exclusively for customers (could be on Zoom or Insta Live with a private link) where you perhaps give them a sneak peek of upcoming launches or just chat, that’s a perk no big corporation can easily offer.

You, as the influencer-founder, are the best ambassador for your brand- use that advantage fully. Community-driven brands also get a ton of word-of-mouth. People rave about the product because they feel part of something, not just consuming. In India, where trust in advertising is low, peer word-of-mouth is gold. So, turning customers into a fan club that recruits others is how you scale without proportional marketing spend.

7. Leverage Omni-Channel Wisely (D2C First, Then Strategic Offline)

While a strong D2C (direct online) presence is the foundation, hitting real scale in India often requires an offline or marketplace component eventually (because a huge chunk of retail still happens offline or on big marketplaces like Amazon/Flipkart). The playbook here is: prove demand and refine the brand in your own channel first, then take it to wider distribution. Don’t rush to list on every marketplace on day one- your product might not stand out without the brand story around it, and discounts/commissions can bleed you. But after a few successful drops and a growing community, identify where an offline presence could amplify things. It could be as small as a pop-up store in a mall where a lot of your fans are (doing a meet-and-greet at a pop-up to drive sales). Or it could be partnering with a retail chain for a limited trial- e.g., your beauty product in 50 Nykaa stores as an exclusive, or your fashion line in a Capsule collection at Shoppers Stop. The idea is to meet your fans where they shop, beyond just your website, once they’re asking for it. Also, retail availability can bring new customers who discover the brand in stores (especially if you get placement in a well-aligned outlet). Logan Paul and KSI went to Walmart after hype was built; similarly, perhaps an Indian creator brand could go to say Reliance Retail or Spar superstores after establishing itself online. Being on shelves also adds legitimacy in consumers’ eyes (“I saw this in Lifestyle, it must be good”).

But caution: offline retail in India has its own challenges (listing fees, negotiations, slow payments). So tread carefully- likely best tackled with experienced partners or after you’ve got enough cash flow. Alternatively, marketplace online channels (Amazon, Flipkart) can be tapped with specific strategies: maybe create an exclusive SKU for Amazon so you don’t just compete on price directly with your own site, and you can leverage Amazon’s fulfillment to reach remote areas faster. The larger strategy is omnichannel, but phased- nail the cult brand status online, then expand footprint without diluting brand ethos.

8. Storytell, Don’t Just “Promote”

This might sound generic, but for influencers, it’s make-or-break: you must maintain an authentic voice when pushing your brand. If your feed suddenly becomes only ads for your own product, you’ll resemble those MLM hun bots that people distrust. Instead, integrate your product naturally into your content, the way you would integrate a beloved item even if it weren’t yours. Share the process- behind the scenes of development, your personal struggles that led you to create this, real testimonials from early users. Continue being a content creator, now with your brand as part of the story. Casey Neistat, a filmmaker and YouTuber, co-founded a company (Beme, later sold to CNN), and he vlogged the journey, making viewers feel part of it. That sort of transparent storytelling can build huge loyalty. In Indian context, for example, if you’re launching a nutrition bar and you’re a fitness influencer, document your R&D trips, how you chose ingredients, even failures (“our first batch tasted awful, here’s what we changed”). This kind of content makes your audience root for you and see the product as high effort (not just a cash grab). Also, address concerns upfront- if, say, some fans comment “oh this is pricey” or “is this just white-label?”, tackle it head-on in a video or post: explain your costs, your formulation uniqueness, etc. When people see your honesty, it disarms criticism and builds trust. It’s tempting to go into “corporate PR” mode when launching a brand, but as an influencer, your strength is being a relatable individual, not a faceless company. So retain that. This doesn’t mean not doing conventional marketing at all- feel free to run Instagram ads or work with other influencers to promote your brand if needed, but ensure the core narrative stays personal and real. Also, don’t hype what isn’t true- if your first version has flaws, acknowledge them and promise to improve. It’s better to under-promise and over-deliver, especially when your name is on the line. Authentic marketing may not give the immediate sugar high of gimmicky ads, but it will sustain the brand through the ups and downs.

9. Plan for Sustainability: Repeat Business and Longevity

Acquiring a customer (even if initially via your “influence”) is costly, so once you have them, focus on retention and lifetime value. Think beyond the first purchase: how will you keep them engaged and buying again? Some tactics: introduce a subscription or membership if applicable (e.g., monthly skin regimen box, or a membership that gives early access to drops and a small discount). It not only locks in recurring revenue but also makes the customer feel part of an inner circle. Keep releasing newness at a smart cadence- e.g., a new flavor, color, or design every couple of months to give reasons for repeat purchases (but balance this with not expanding too unfocused). Use email/WhatsApp marketing to stay in touch with customers, but provide value in those messages (tips, community stories, not just sales pitches). Essentially, the goal is to evolve from “an influencer selling something” to a brand that people genuinely like on its own merit. That transition happens when customers who aren’t even your hardcore followers start buying because they heard the product is good. To reach there, you must deliver quality consistently and nurture customer relationships. Also, pace yourself. Don’t blow all hype in first 2 months. It’s better to have steady growth than huge spike and complete drop-off. Internally, set a vision that spans 3-5 years: maybe year 1 you focus on one category, year 2 you add a related category, year 3 you expand to retail, etc. This long-term thinking will influence how you make decisions daily (for instance, you won’t resort to spammy marketing that could burn goodwill for short-term sales). In practical terms, measure things like repeat purchase rate- if it’s low, find out why (is the product not good enough? too expensive to rebuy? or just that you aren’t remarketing?). Solicit feedback regularly and iterate. A creator brand must be nimble- use the feedback loop from your community to improve product or add features. Those improvements will keep people coming back. The holy grail is when your brand earns referrals beyond your own reach- friend to friend, family to family. That’s when you know it’s on solid footing and not solely dependent on your celebrity. Many influencers forget to cultivate that and just chase new customers via their posts, which can lead to a plateau once your followers have either bought or decided not to. Sustainability comes from treating this as a serious business with customer-centric decisions, not a one-time popularity harvest.

Monetization After the Launch Buzz: Tactical Strategies

Launching your brand is just Day 0. Once you’re in the market, you should continuously look for ways to monetize smarter and deepen revenue streams. Here are some tactical strategies for creators post-launch:

Limited Edition Collaborations: Even after you have your own brand, consider doing collabs within it. For example, a limited-edition product in partnership with another creator or a designer. This could pull in a fresh audience. Limited editions also create spikes of sales and keep the brand feeling dynamic and trendy.

Seasonal Drops & Events: Plan your calendar to leverage seasons, festivals, and sales events. An Indian influencer brand could do a special Diwali drop or a Summer edition of a product. Tie it with content (“Diwali makeup look using my palette” or “Get monsoon-ready skin- introducing our new moisturizer”). Seasonal relevance can draw in customers who might be shopping around that time anyway. Also participate in big sale days (like if on marketplaces, the Diwali sale, etc.) but ensure you offer something unique, not just discounts- perhaps a bundle or gift with purchase exclusive to that event.

Referral and Ambassador Programs: Turn your happy customers into your salesforce. Implement a simple referral program (my portfolio company, ReferRush, can help with that!). People are more likely to try a new brand if a friend recommends it with a discount. You, as an influencer, likely grew through shares; apply the same principle to the product.

Content-to-Commerce Integration: Double down on content that directly drives sales. This could mean hosting live shopping sessions on Instagram/YouTube where you demonstrate the product and share a link to buy. You could also produce content series (like a YouTube vlog series) around building the brand or challenges that feature your product heavily, subtly advertising through storytelling rather than a typical ad.

Explore Offline Presence with ROI in Mind: As discussed, going offline can boost monetization if done right. You might test pop-up kiosks in high footfall areas where your demographic hangs out (malls, college fests, events). These can generate direct sales and also serve as marketing. For instance, a weekend pop-up that sells out 500 units also creates local buzz and yields content (record it, post on social media). If feasible, do meet-and-greet events at these pop-ups- fans come to see you and end up buying. Offline experiments should be evaluated on both sales and marketing ROI, since some may just break-even in revenue but gain you lots of new social followers or email sign-ups (which have future value).

Upsell and Cross-sell: Once you have a customer, think of what related product or service you can offer them next. This is classic in any business, but worth emphasizing. If someone bought your fitness protein, maybe a month later, you pitch them your new gym merch or a diet plan e-book. If they bought a dress from your fashion line, maybe upsell matching accessories. Use data- track what combinations of products people buy and promote complements. Basket size expansion and repeat purchase frequency are key to hitting good revenue numbers without needing proportional audience growth.

Licensed Extensions: Once your brand has some cachet, you could monetize by licensing your brand name to other products (manufactured by partners), essentially extending your brand’s reach and earning royalties without heavy investment. This strategy has made celebrities billions (think merchandise, perfumes, etc.). For an influencer example: if you have a strong brand identity, a partner might approach you to make, say, a line of home decor under your brand, where they do the heavy lifting and pay you a royalty per sale. But tread carefully- only do this if the partner’s product quality and ethos match yours, otherwise it can backfire on your brand reputation. Done right, it’s a way to enter new categories and earn passive income on your brand equity.

Strategic Partnerships: Beyond direct selling, monetize via partnerships. If you’re a food influencer with a spice blend brand, maybe tie up with a meal kit service to include your spice in their kits, earning wholesale revenue. Or if you have a tech gadget, partner with a telecom operator for a bundle deal. These deals can significantly boost volume by leveraging someone else’s distribution, effectively monetizing your product in new channels.

Double Down on Best-Sellers: Use sales data to identify your best-sellers (the 20% of SKUs driving 80% of revenue). Then double down. Promote them more, create variants of them, consider raising the price a bit if demand is high, and make those items ubiquitous. Every strong brand has a flagship that carries the financial weight. Don’t be afraid to put marketing spend behind a proven winner to scale it further- even influencers might need to invest in ads beyond organic reach once the audience limits are hit. A rupee spent on marketing a highly converting product is worth far more than a rupee spent on a slow mover. So allocate resources smartly to monetize the hits.

These tactics, executed well, can significantly increase a creator brand’s revenue beyond the initial launch surge. They ensure you’re squeezing the full potential out of your audience and customer base, and also reaching new customers efficiently. The underlying theme is to treat the brand as a growing organism. Feed it with new ideas, channels, and improvements constantly so it keeps yielding returns.

Monetizing Collaborations After Launching Your Own Brand

One of the most complex dilemmas for influencer-founders is this:

"How do I keep monetizing my audience via brand collaborations without sabotaging my own product?"

It’s especially tricky for creators in highly monetized verticals like skincare, wellness, or beauty, where sponsored content is often the bread and butter.

Let’s say you’re a wellness influencer known for Ayurveda, natural skincare, and home remedies. You’ve likely built trust by endorsing several external brands. But once you launch your own skincare brand, that model breaks- unless you adapt it strategically.

Here’s a solution framework that allows continued revenue from partnerships, while preserving loyalty to your own brand:

1. Build Category Walls (Hard and Soft)

Hard Wall (Non-Negotiable):

Once you launch your skincare brand, stop promoting any other skincare products- no cleansers, no serums, no sunscreens from other labels.

You’ve moved from being a skincare enthusiast to a skincare entrepreneur. The switch must be clear to your audience.Soft Wall (Adjacency-Only):

What can you still promote?Wellness experiences (e.g., retreats, yoga platforms)

Food & drink (within reason, and ideally not ones with competing health claims)

Lifestyle services (apps for mental health, sleep tracking, etc.)

Everything you promote now needs to strengthen your brand story, not distract from it.

2. Shift from Promotion to Positioning

Don’t frame partnerships as “I love this product”. Reframe them as:

“This is part of the lifestyle I embody as a founder of my own wellness/skincare brand.”

Example post:

“I’ve been working on my own skincare line for over a year now. A huge part of that journey is stress management, and that’s why I’m excited to explore [X meditation app]. Because no product can help you glow up like peace of mind can.”

This keeps your voice consistent and your credibility high.

The audience sees you as someone living the values your product claims to deliver.

3. Reduce Volume, Increase Alignment

It’s time to move from 12-15 monthly brand deals → to 3-5 high-quality, brand-aligned partnerships.

Negotiate:

Longer-term deals with lifestyle alignment (not one-off ads).

Access-based deals: collaborations that grow your brand’s reach, not just yours.

A perfect example:

Emma Chamberlain, after launching Chamberlain Coffee, drastically cut down beauty/fashion ads and shifted her content to showcase wellness, rituals, and coffee culture, even when posting from other brands' cafes.

Her paid collabs subtly fed into her coffee brand’s aesthetic ecosystem. The message stayed clear: “This is a founder-led lifestyle.”

4. MrBeast-Style Ownership Framing

MrBeast doesn't stop collaborating after launching Feastables, he just frames every collaboration around his products.

His challenges and videos now feature Feastables giveaways or integrate the product into the content flow.

He doesn’t say, “Here’s a brand I like.”

He says: “Here’s what we built, and how it’s changing the game.”

The takeaway for influencer-founders: make your own brand part of your influencer persona- the default mode of collaboration.

5. Own Your Channels, Not Just Promote on Them

Gradually pivot your monetization model from "sponsored content" to "branded media."

Examples:

Host live sessions or IG Lives where you share “behind the scenes of building [Your Brand Name]” and charge for premium access.

Create bundled experiences: skincare tips + journaling guides + seasonal product drops.

Build a subscriber list (email/WhatsApp) that you own, where your brand is the centerpiece.

This way, your social media channels become content-to-commerce flywheels, not ad slots.

Quick Timeline Example:

TL;DR — How to Monetize Without Cannibalizing:

Say NO to direct category competitors

Say YES to adjacent partners that build your lifestyle narrative

Refocus collabs around your values, not just product plugs

Build long-term monetization through owned audience funnels

Use collabs to enhance your founder persona, not blur it

So, Ready To Build?

For Influencers (Creator-Founders):

Choose Your Niche and Product Wisely: Audit your own content and follower base- what problem are you uniquely positioned to solve? Pick a product category that aligns 100% with your personal brand and audience interest. Do not venture into something just because it’s trendy or high-margin if it doesn’t resonate with your story (e.g., don’t launch protein powder if your content is mainly comedy; your credibility won’t carry). Be honest about what your followers see you as an authority in or what lifestyle they aspire to through you.

Commit Long-Term (Mentally and Financially): Treat your brand launch not as a campaign but as the start of a new career as an entrepreneur. That means potentially investing your own money (or foregoing some easy endorsement cash to focus on this), clearing time in your schedule beyond content creation, and being prepared to grind for years. Set expectations with your management/team that this is now a core part of your identity. Skin in the game is crucial- ensure you retain significant ownership and decision-making, and tie your success to the brand’s success.

Find a Complementary Cofounder or Team: If you’re not from a business background, partner with someone who is. This could be a co-founder, or an early senior hire (like a COO or product head) who has built or worked in startups, understands operations, finance, compliance, etc. Check your ego- being a majority owner doesn’t mean you have all the skills; hire/partner to fill gaps. Make sure incentives are aligned (give equity or profit share) so they are as motivated as you. Build a mini “founding team” around you rather than doing it all solo.

Engage Your Audience in the Journey: Right from pre-launch, bring your followers along. Tease the work you’re putting in, solicit input (polls, Q&A about what they want), and make them feel this brand is for them. Keep the interaction going post-launch- repost their reviews, thank them, and create community forums. Maintain authenticity: continue to create your regular content too; don’t turn your feed entirely into an ad, or you risk losing followers. Balance is key- follow a rule like 80% regular content, 20% brand content, and integrate them whenever possible. Authentic advocacy of your own product (using it in daily life naturally in vlogs, etc.) will sell better than overt sales pitches.

Lead with Transparency and Integrity: Set a high bar for quality and be transparent. If something goes wrong (delayed shipment, product issue), address it openly and fix it. Don’t overpromise in your marketing. As an influencer, your word is your bond- one scandal or major disappointment can destroy both your brand and your reputation. So, ensure the product truly works as advertised. Personally test everything. If you wouldn’t spend your own money on it, don’t sell it. Protect the trust your audience has in you as sacred, even if it means swallowing costs (like recalling a batch, or refunding unhappy customers generously). In the long run, that trust is the foundation of brand loyalty.

Stay Involved and Accessible: Post-launch, don’t disappear behind a CEO or team. Your personal touch is your brand’s secret weapon. Continue engaging directly with customers on socials, answer some DMs about the product, show up to package orders on a busy sale day and post that- these things might seem small, but they humanize the brand and motivate your team too. Internally, regularly sync with your ops and customer service to hear feedback from ground level. Essentially, remain the chief evangelist and also a student of your business. As your brand scales, it’s fine to delegate execution, but always keep a pulse on what’s going on and show your face to your community and employees- it will keep the original spirit alive.

For Founders/Operators (Building with Influencers):

If you’re not the creator but the founder/operator trying to build with them, your job is even harder.

You are:

Chief Adult in the Room

Chief Unit Economics Enforcer

Chief Hype-to-Reality Translator

Your mission:

Help creators become real founders without letting emotion or ego burn the business to the ground.

Here’s exactly how you do it.

Validate Product-Market Fit Beyond the Hype: As the operating partner, make sure the product idea has legs beyond the influencer’s existing fan hype. Do basic market research- is there a gap for this product? How are competitors priced? Use the influencer’s audience for fast feedback (survey them on preferences). Don’t get blinded by follower numbers. An influencer launch can give a great head start, but for a sustainable business you need product-market fit in the broader market too. Pressure-test assumptions: would a stranger buy this at this price if it weren’t tied to X influencer? If not, what needs to change?

Build Robust Operations from Day One: Treat this like any high-growth startup. Set up reliable manufacturing/supply chain (possibly have backups or multiple suppliers to mitigate risk). Invest early in a good e-commerce stack (site that can handle traffic spikes, integrated payment gateways including COD options with fraud checks, etc.). Plan logistics- partner with delivery services known for COD handling, enable quality checks. Implement clear SOPs for customer service (train reps on the brand tone, common questions). Essentially, assume this will scale big and lay foundations accordingly. It’s hard to retrofit good ops later. If volumes surprise you (in a good way), you’ll be thankful you built a solid infrastructure. If volumes grow slowly, a strong ops base will allow steady scale without collapsing. Keep a close eye on unit economics- factor in influencer’s commission or profit cut, COD losses, returns, etc., to ensure you’re building a viable model, not just burning money for vanity metrics.

Align Closely with the Influencer’s Voice: As an operator, you might be doing a lot of behind-the-scenes work, but remember that the brand’s DNA is the influencer’s persona. All outward communication, packaging copy, marketing strategies should align with their voice and values. Spend time with the creator to truly understand their community. Do not launch campaigns or responses without syncing, especially early on. One off-tone tweet or a generic ad can turn off loyal fans. Basically, avoid the trap of treating this like a typical corporate brand; leverage the quirky, personal style of the influencer in all brand touchpoints. That’s what makes this venture special. On the flip side, also be the gatekeeper of the brand’s reputation- if the influencer founder does something controversial unrelated to the brand, have a PR plan (influencers are human and can make mistakes; the brand has to weather that). This is a unique challenge for operator: managing the symbiosis between a living personal brand and the company brand.

Use Data to Drive Decisions: Once launched, track everything. Which SKUs sell best, which cities have most orders, what is COD vs prepaid mix, where is RTO highest, what’s our customer acquisition cost, etc. Analyze follower data too (e.g., if the influencer’s YouTube audience responds more than Instagram audience in conversion.) Use this to optimize marketing spend and inventory. If one product is a hit and another is lukewarm, pivot focus quickly rather than equal push. Being data-driven will help counter any emotional bias the influencer might have (they may love a product that isn’t selling- you need to gently push the business case). Also, map the overlap between the influencer’s followers and actual customers- you may find new customer segments emerging (e.g., friends of fans, or a certain demographic buys most). This can inform potential broadening of marketing beyond the core audience over time. Essentially, be the analytical compass complementing the influencer’s creative compass.

Plan for Growth Milestones & Scale Tactically: Set clear milestones- e.g., X revenue by month 6, Y% repeat rate, launching on marketplace by month 9, etc. This helps keep the team focused and allows objective evaluation of progress. Have a realistic financial plan: maybe the influencer can drive the first 10,000 orders via organic push, but after that, how do we reach the next 50,000 customers? Likely you’ll need to invest in ads, PR, retail channels or additional influencers for promotion. Budget and plan for those, and get buy-in from the creator that that’s necessary (some influencers think posting on their own feed is all that’s needed forever- an operator knows otherwise). Also, be ready to raise capital or allocate more if it’s working. Don’t be afraid to scale up production and marketing when you see strong traction, just do it intelligently (e.g., stock up your hero SKU when you see demand trending, rather than spreading resources too thin). Conversely, if something’s not working, iterate quickly- change the formula, packaging, or even consider a pivot to a different product if the data is clear. In short, steer the ship with a growth mindset, using both the wind of the influencer’s popularity and the engine of sound business strategy.

Ensure Incentive Alignment & Manage Expectations: From day one, have frank discussions with the influencer about revenue sharing, profit distribution, investment needed, and timelines. Put it in writing (founders’ agreement). Influencers might be new to the concept of spending money to make money e.g., reinvesting profits into inventory or marketing instead of taking it all home. Educate and align on that. Set an expectation that the first year or two might be about growth > profit (or whatever your strategic choice is) so they don’t get disillusioned. Also, decide roles: maybe the influencer is the creative director and you are the business operator- respect each other’s domain but keep communication tight. If the influencer has multiple projects (they often do), work out how they will allocate their time for the brand- perhaps they shoot content for it X days a month or attend a weekly meeting. Holding each other accountable is key. As the operator, make the influencer’s life easier in running the brand so they can focus on their strengths, but also require their input on things only they can do (like appearing in marketing material, engaging with fans). A well-oiled partnership where both sides know their responsibilities will prevent frustration down the road.

Brands are Built. Attention is Rented.

India doesn’t have a Kylie. Or a MrBeast. Or a Prime.

Yet.

But we will. And soon.

Someone is going to:

Treat their audience as distribution, not just engagement

Build real loyalty through scarcity and focus

Align their revenue with performance

Think long-term, not launch-only

And they’ll build India’s first unicorn influencer brand.

That person might be a creator.

It might be an operator.

It might be a founder reading this essay right now.

The gap is real. The playbook is ready. The market is maturing.

Followers can disappear. Algorithms can change.

But a brand, if built properly, compounds over time.

Indian creators have sat on a goldmine for years, but few have dared to do the unsexy work of building real companies instead of chasing campaign checks.

That window is closing. Fast.

The next 3-5 years will define who:

Owns actual IP

Builds category-defining brands

Controls distribution pipes

Outlasts platform churn

If you’re willing to eat a few hard years of slow, grind-it-out brand-building,

You’ll own something far more powerful than attention.

You’ll own equity.

And equity is where real wealth- and real cultural impact- lies.

The only question left:

Are you going to rent your brand?

Or are you going to build it?

This is an interesting take, had a bunch of thoughts but too long for a write up.

So here's a TL;DR:

Influencer-led commerce in India faces structural challenges. Most influencers are entertainers, not domain experts, and Instagram is primarily an entertainment [Indian context] platform—not a sales engine.

India’s sharp economic divide (140M affluent vs. 1B budget-conscious) limits conversion potential. High return [RTO/RTV] rates for unfamiliar, couriered products add friction.

While entertainment thrives (e.g., IPL, Reels), it rarely translates to meaningful commerce, especially when trust and product expertise are missing.

Would love to have a chat or AMA on this with your team sometime :)

Such a great read!